LATEST

SI-ALPINE

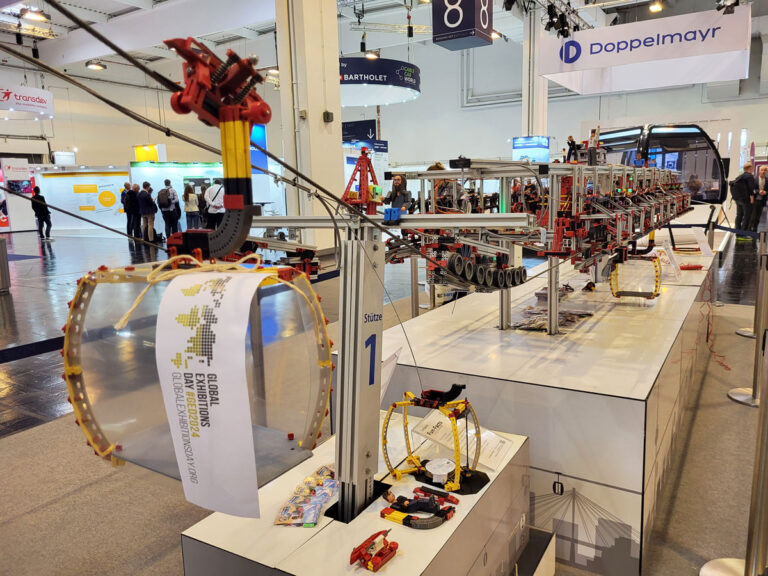

Cable car model urgently needs shelter

A desperate plea for help has reached the SI editorial team. The Fischertechnik cable car model at a 1:10 scale is about to lose its home and is urgently looking for a new place to stay. The world’s largest and most complex Fischertechnik model is at risk of being dismantled — along with a project into which 25 volunteers have poured thousands of hours of work. Can someone from the industry step in to help?

Global Sustainability Ski Alliance

Eight leading ski resorts – from New Zealand to Austria and Norway – are joining forces for sustainable tourism. At the Interalpin trade fair in Innsbruck, the Global Sustainability Ski Alliance was officially launched – the first initiative of its kind in the ski industry.

Trump’s tariffs: How severely do they impact the European cable car industry?

A possible increase in US tariffs to as much as 20 percent is causing concern in Europe. The American market is also important for the cable car industry. How severely are suppliers in the Alpine region affected – and what can they do about it? An assessment from those affected and industry experts.

KFX by Kässbohrer saves time and money

With the unique KFX fast exchange system from KÄSSBOHRER for the rapid attachment and removal of rear attachments in under 30 seconds, an exceptionally efficient, flexible and targeted use of the PistenBully with or without a tiller is possible.

RELEVANT

TOPICS

Tools for heroes from Bächler

To mark the 50th anniversary of INTERALPIN 2025, the Swiss lance expert has launched its new campaign, TOOLS FOR HEROES, putting snowmakers in the spotlight. Despite the cold, they create perfect slopes. BÄCHLER, in turn, helps them work more comfortably and efficiently.

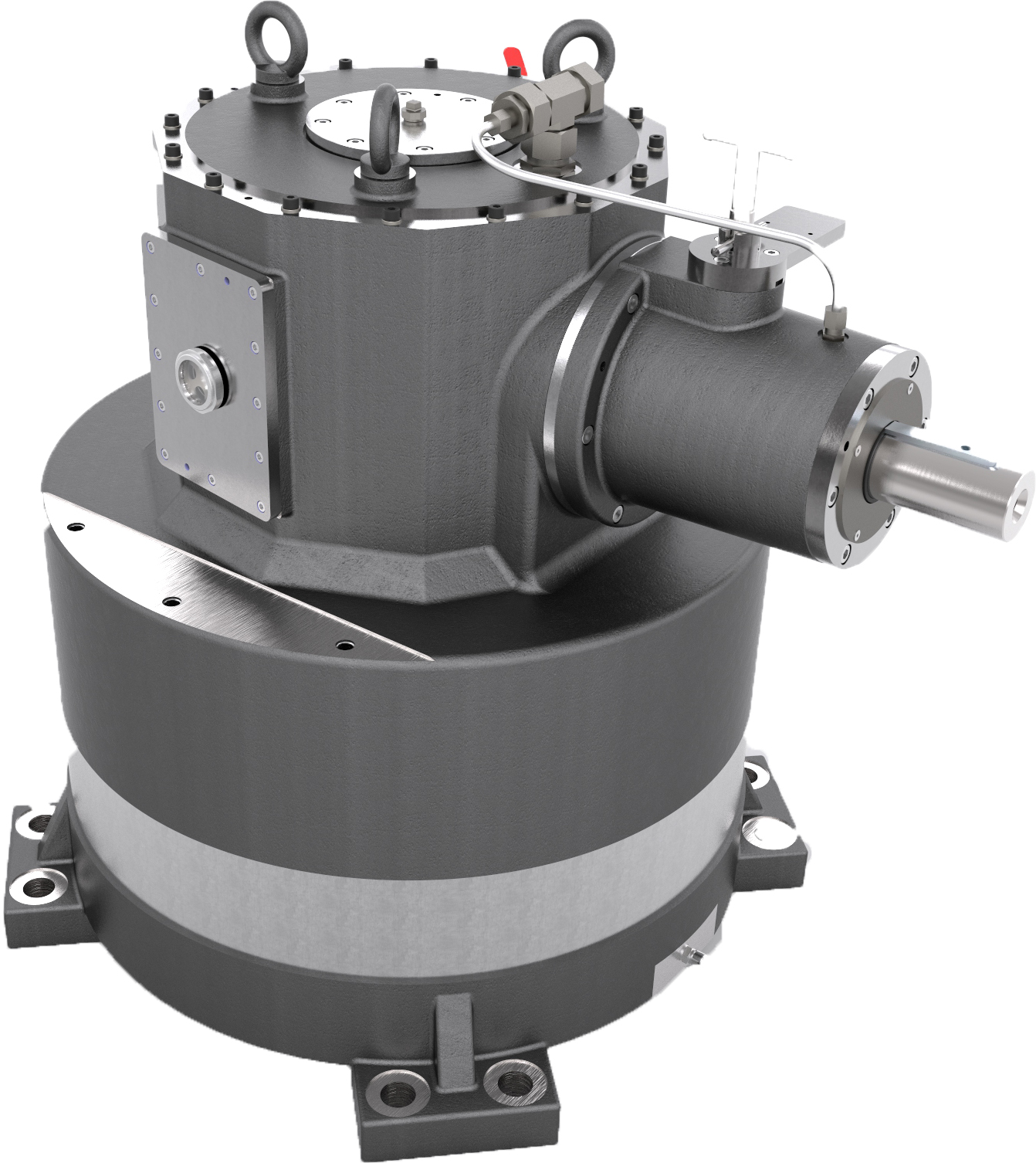

100 years of Kissling AG: Revolution with gears

Since 1925, KISSLING AG has been developing, producing, and maintaining gears across a variety of industries. In doing so, its ropeway division has emerged as the most important segment. Why do so many alpine and urban cable car operators trust the Swiss company?

Doppelmayr clair: now supports planning

Well planned is half done: With new extensions to the clair maintenance software, cable car manufacturer DOPPELMAYR is now also simplifying the planning of inspections.

LATEST

SI-URBAN

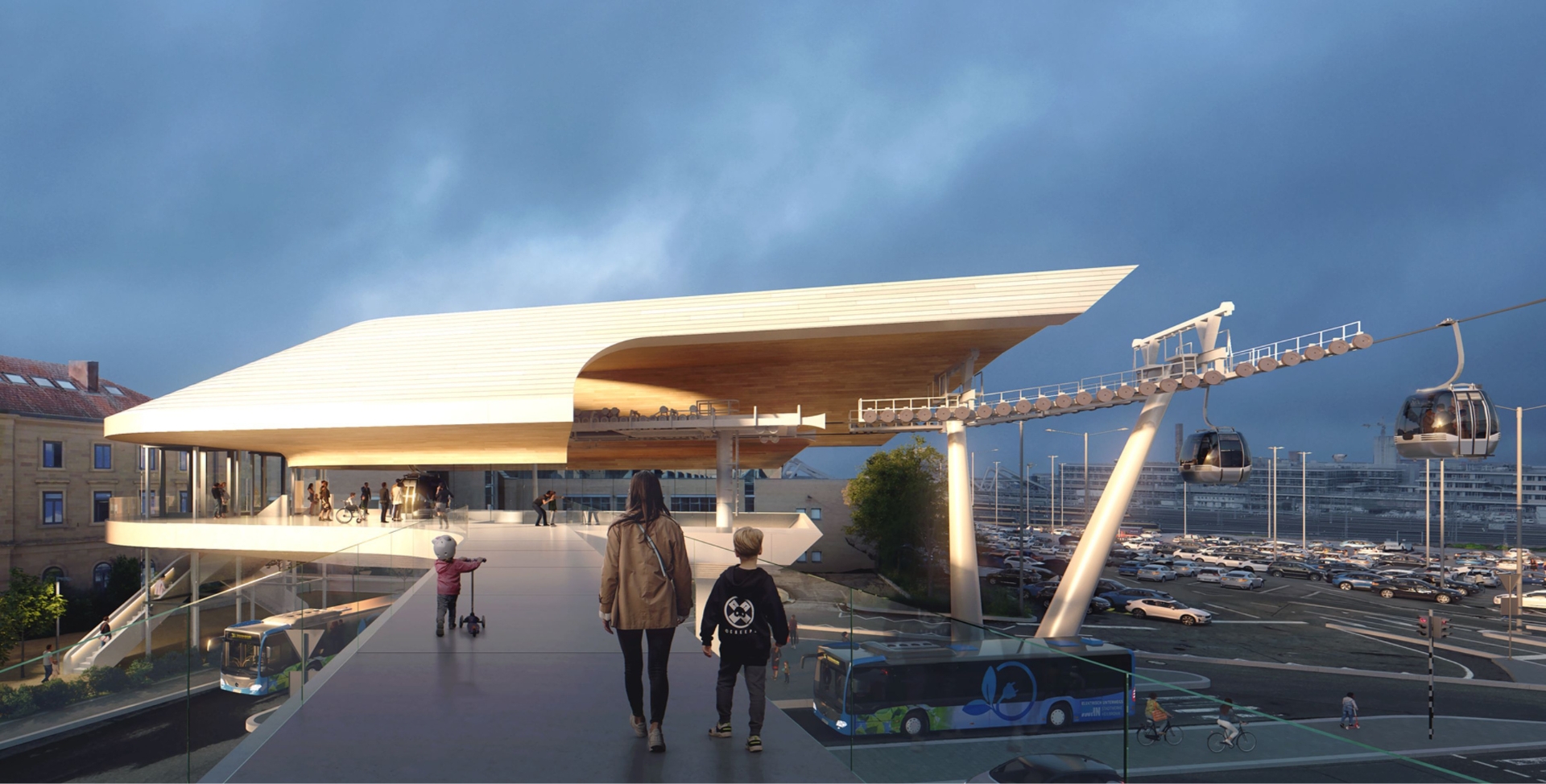

Trieste: Construction of the cable car to begin this year?

With financial support of €48.7 million from the National Recovery Plan, the urban cable car in Trieste (Italy) is becoming a tangible reality. Construction could begin by the end of 2025, reported Giulio Bernetti. The director of the Department of Urban Planning, Environment, Public Works, and Cultural Heritage of the City of Trieste presented new details about the planned facility at the INTERALPIN trade fair.

Minister in SI Interview: Three Urban Cable Cars for Chile

In June, a tender was launched in Chile to build a cable car that will connect the cities of Iquique and Alto Hospicio. The project is expected to cost around 126 million dollars. In addition, several more urban cable cars are planned across the country. Chile’s Minister of Transport, Juan Carlos Muñoz, spoke about the initiative in an interview with SI at the UITP Summit.

India: Cable Car Development Program with Four Billion Dollars in Investments

"The market for urban cable cars in India is set to explode," promised Prashant Jain, Vice President of the Cable Car Division at the state-owned National Highway Logistics Management Limited (NHLML), at the leading global trade fair INTERALPIN in Innsbruck, Austria. Together with the overarching Ministry of Transport, NHLML presented India's ambitious development program for urban cable cars.

Cable Car Project in Bonn: New Phase

The planned urban cable car in the German federal city of Bonn is gaining momentum: The previous municipal planner is currently handing over knowledge and documents to the consulting firm specializing in construction and infrastructure.

RELEVANT

TOPICS

Mexico: Two new cable cars in Morelia and Naucalpan

In Mexico, the cable car manufacturer LEITNER is building two new systems in the cities of Morelia and Naucalpan. As a result, the cable car network established by LEITNER in Mexico will expand by 15 kilometers to a total of 40 route kilometers by 2026.

Ajaccio: Cable car under construction in Corsica

“Angelo“ is the name of the urban cable car with three sections, set to open in Ajaccio, Corsica, in 2025. It will form an intermodal system with the bus network and shuttle boat lines. Construction is progressing, and the POMA cable car blends seamlessly into the landscape.

Millions for cable car in Heilbronn

The vision of an urban cable car in Heilbronn (Germany) is coming within reach: the state of Baden-Württemberg and the city of Heilbronn have signed a joint declaration of intent to implement the project. There is also the prospect of funding in the millions.

Bogotá: The cable car that changes lives

Latin America is the most urbanized region in the world and simultaneously suffers from social inequality, poverty, violence, and poor transportation connectivity. To address these issues, at least 13 cities have introduced cable cars to improve accessibility in steep areas. Bogotá, the capital of Colombia, followed this trend in 2018. But how has this affected the people in the affected neighborhoods? Researchers set out to find answers.