Management & Tourism, SI World 2/2023

Hopes & Fears: Season worldwide

The 15th edition of the global ski resort study analyses the past ski season 2021/2022. According to the study, the industry has recovered well after the two pandemic years. „Globally, visitor numbers in 2021/22 are on average for the past 20 years.

Australia, Bosnia-Herzegovina, China, USA, Finland and Sweden have even reached their best visitor numbers ever,“ reports study author Laurent Vanat.

Since the early 2000s and prior to the Covid 19 pandemic, annual attendance at ski resorts has fluctuated, mainly due to weather and snow conditions, and has ranged from 323 to 389 million skiers worldwide.

The closure of the Alpine countries in the winter of 2020/21 caused the most dramatic drop in visitor numbers during this period, with only 201 million skiers.

Although operations in ski resorts did not return to full normality everywhere, more than 370 million skier visits were recorded worldwide in the winter season 2021/22.

Reasons for the recovery

According to Vanat, this positive development is due to the following factors, among others: First, the weather was favourable in many places: snowfall was limited in some places, but cold temperatures and sunny days made for good skiing conditions.

Secondly, people increasingly demanded outdoor activities and domestic destinations, which benefited ski resorts (whose biggest markets are domestic). Third, many countries eased pandemic-related restrictions.

Fourth, the ski industry in some Eastern European countries has been consistently strong. Fifth, the number of skiers in China continued to grow to the 2022 Beijing Olympics and despite remaining restrictions on Covid-19.

Sixth, ski area operators resumed construction and overhaul of facilities that had previously been on hold for several weeks or months.

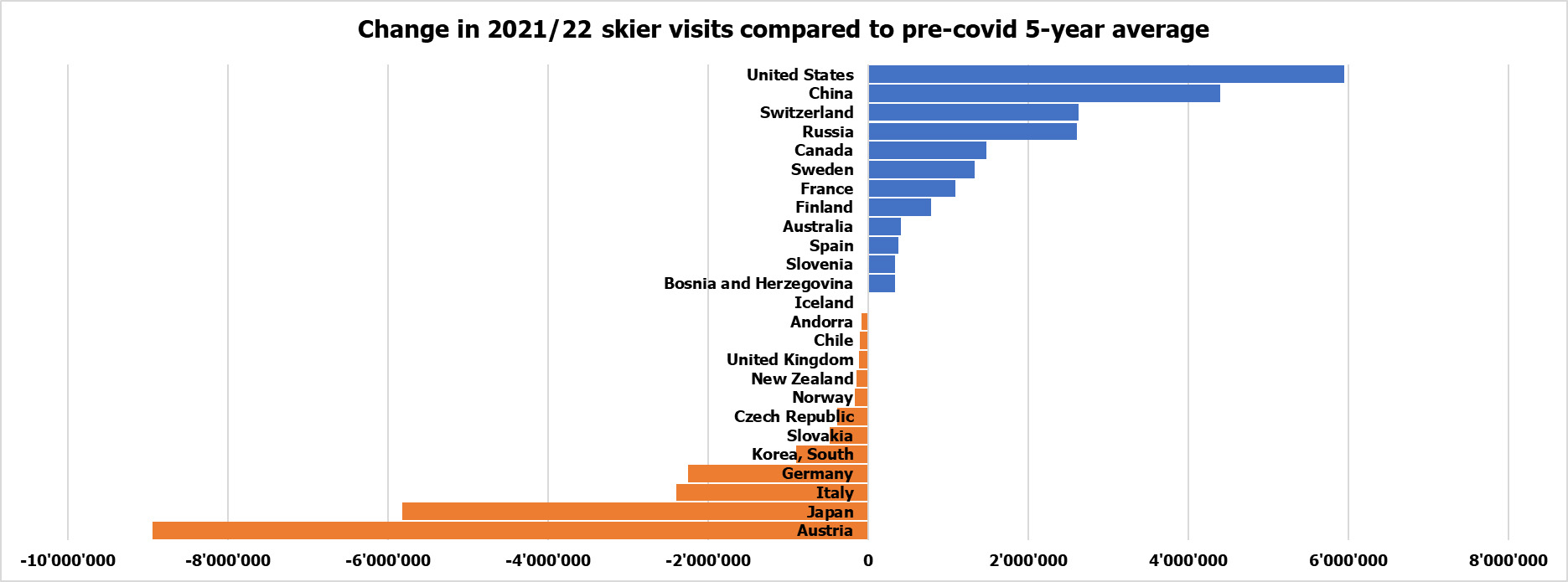

The country comparison

Overall, visitor numbers returned to a normal level. At country level, however, there were winners and losers in the 2021/22 winter season. As in the previous season, some countries were even more affected by the pandemic restrictions than others.

While the United States (rank 1) was more or less business as usual, Austria (rank 3) missed the start of the season. France (rank 2) did quite well, with visitor numbers two per cent above the five -year average.

Switzerland found itself in fourth place. Italy (5th), Japan (6th) and Germany (not even in the top 10) suffered again. Among the top ten are China (7th), Canada (8th), Russia (9th) and Sweden (10th).

Infrastructure figures

The number of ski resorts and cable cars remained almost the same: There are currently 5,827 ski resorts in 68 countries worldwide, of which 1,827 operate five cable cars or more.

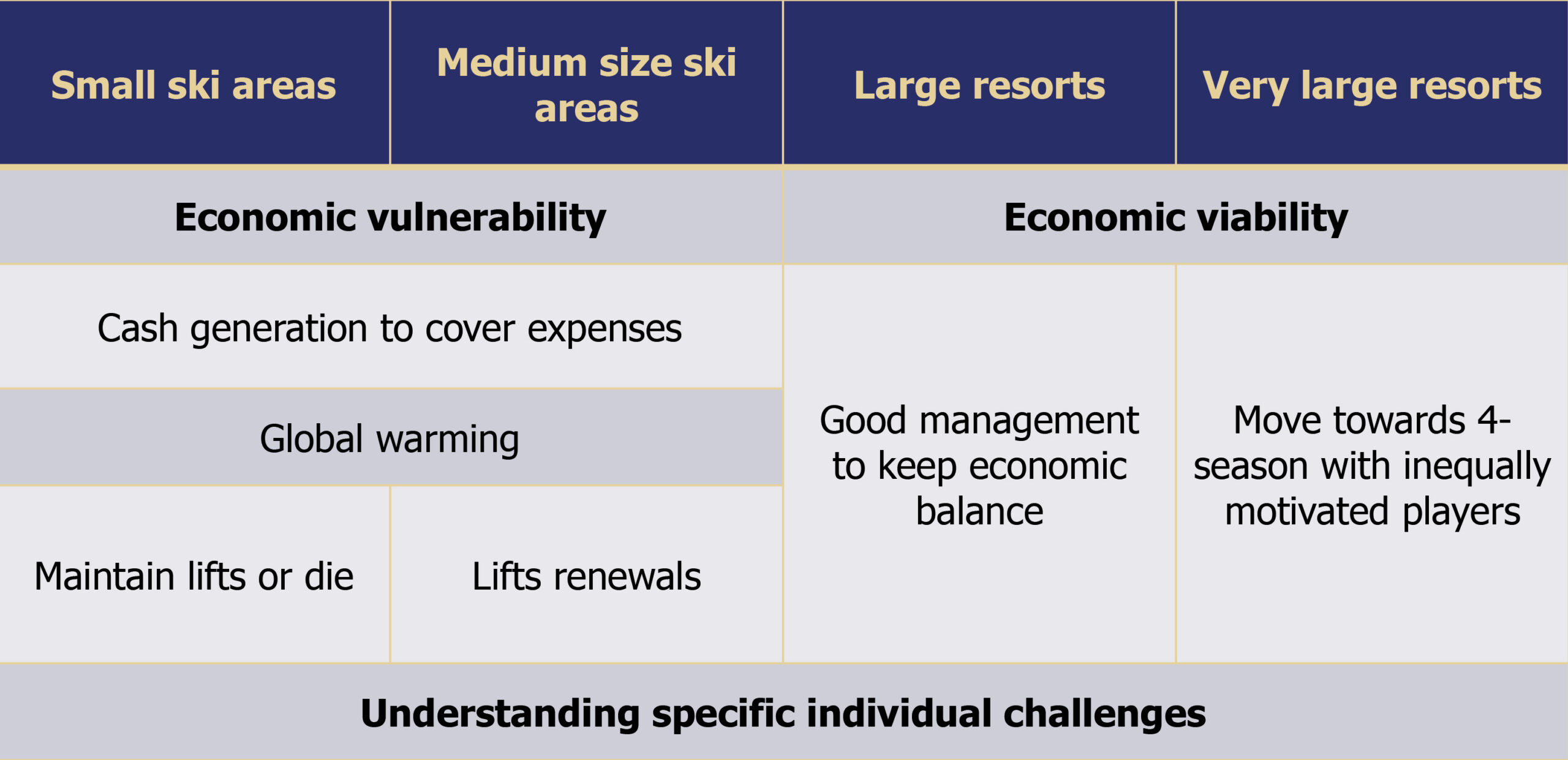

52 ski resorts are visited by one million (or more) guests annually. Structurally, study author Laurent Vanat surveyed 4,000 small, 1,082 medium, 693 large and 52 very large ski resorts: This diversity poses different problems, there is no comprehensive solution for all.“

Specific challenges

Thus, small and medium-sized ski resorts are confronted with their economic vulnerability. They have to generate revenue primarily to cover their expenses.

Climate change is forcing them to invest in technical snowmaking; the demands and influx of guests, on the other hand, are forcing them to build new cable cars or retrofit existing ones.

„Facilities wait or die,“ is how Vanat drastically formulates the situation. But even very small ski resorts can do well. For large and very large ski resorts, it‘s all about economic viability again: how do I best manage the operation to remain economically balanced?

„In addition, competition is pushing for a year-round offer, whereby the players in the market are unequally motivated,“ Vanat emphasises.

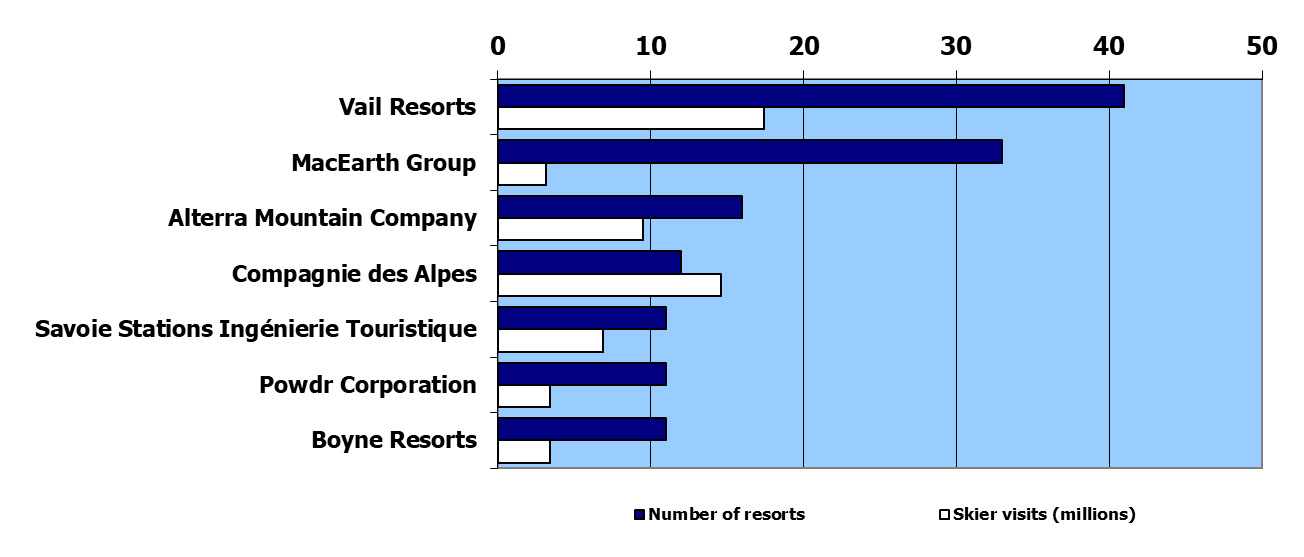

The big players determine the business

The standing of the companies in the industry is also unevenly distributed; the approximately 5,000 small ski resorts are in the majority (87 per cent), but generate only 26 per cent of the worldwide visitor numbers.

The large destinations, on the other hand, account for the lion‘s share of 53 per cent, and very large mountain railways 21 per cent. The seven largest ski resort chains also account for an impressive seven per cent of skier visits worldwide (73 per cent are accounted for by individual mountain railways, ten per cent by other ski resort groups).

„The big league“, as Laurent Vanat calls them, includes Vail Resorts, Mac Earth Group, Alterra Mountain Company, Compagnie des Alps, Savoie Stations Ingénierie Touristique, Powdr Cooperation and Boyne Resorts.

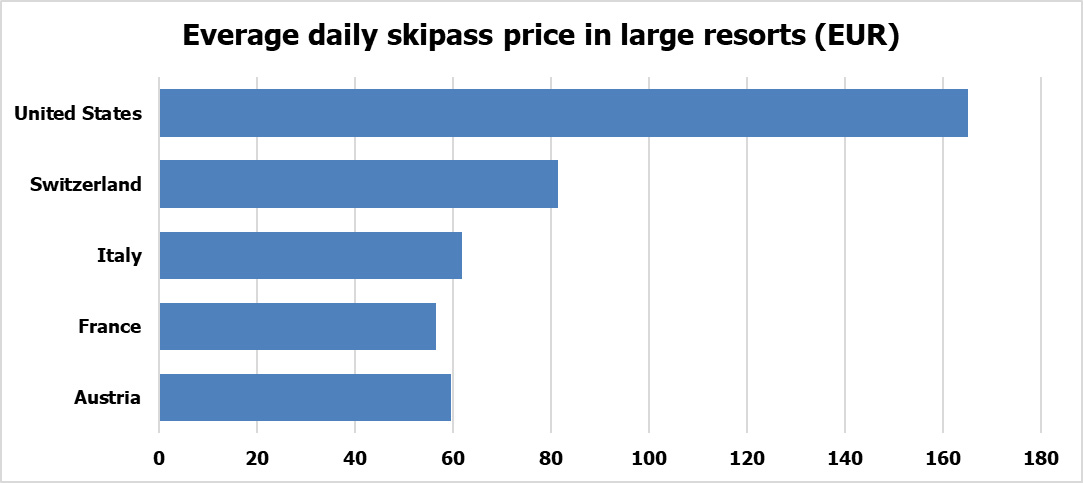

In terms of price, the USA continues to be the most expensive with up to 160 euros per day pass, while the European destinations are significantly cheaper (80 euros – as of 2020/2021. With inflation and high energy costs, prices in Europe will also rise sharply in 2023/2024.