Maintenance & Service, SI World 2/2020

United States: Expensive skiing?

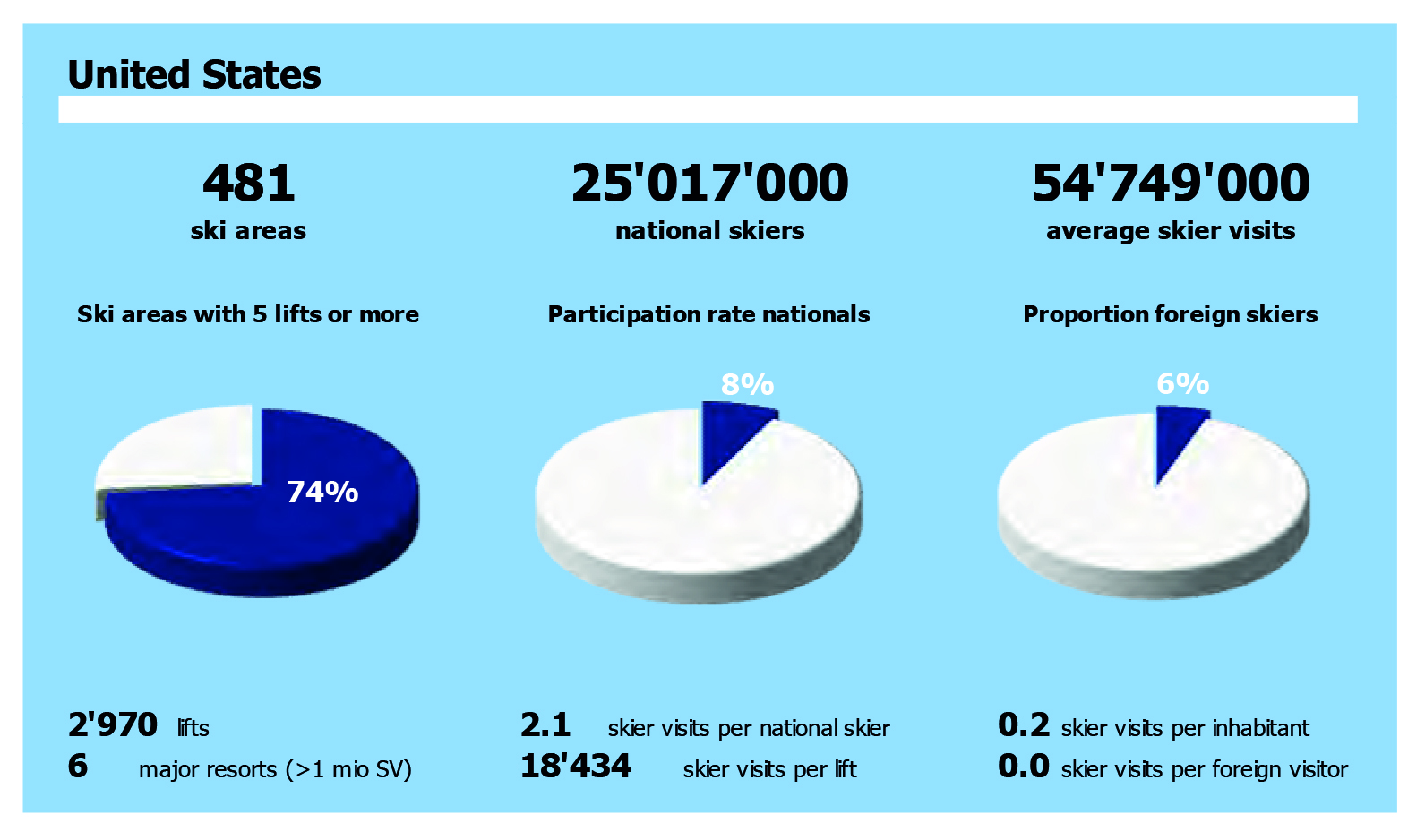

More and more money from fewer and fewer customers – that seems to be the business model of large US ski resorts. The price of the average one-day ski pass rose from 59 US dollars in the 2005/06 period to 130 US dollars in the 2018/19 period, as documented by the 2020 International Report on Snow & Mountain Tourism.

Study author Laurent Vanat therefore poses the question of how sustainable this pricing strategy is. On peak days, one-day tickets such as in Colorado cost over 200 US dollars. Accommodation prices in the American west have also risen sharply: by an average of 30 percent compared with the 2009/10 season.

Such a price level makes skiing unaffordable for many, especially for beginners who rely on oneday tickets and do not benefi t from discount campaigns. Mega-passes, i.e. discounted multiresort season tickets, are therefore only part of the answer.

These have certainly become very popular – around 950,000 Epic passes were sold in 2018/19. However, it is questionable whether beginners and occasional skiers are not more likely to invest in cheaper, multi-day ski tickets.

Chart: 2020 International Report on Snow & Mountain Tourism

Success of mega-passes

Conversely, for the existing target groups, mega-passes have become established. The sales figures rose by 7.5 percent. Estimates indicated that the average megapass holder skied on only around 9.9 days in the 2018/19 season. The fact is: the proportion of season tickets among skier visits rose to 43.4 percent.

That is an increase of 34.7 percent in comparison with the fi gures from ten years ago. Together with excellent snow and weather conditions, mega-passes were able to reverse the negative trend of skier visits in the 2018/19 season. The ski resorts in the USA counted 54.7 million skier visits, which is 11.4 percent more than in the 2017/18 season.

Skier numbers in decline

This is the fourth best result of the last 41 years. However, it also demonstrates that the US ski market is not really making any headway, as few new skiers were acquired. Rather, numbers of active winter sports enthusiasts have been falling each year since 2012/13. In 2015/16, the proportion of skiers and snowboarders in

the US population was estimated at two million.

That is only 2.6 percent. In comparison: over twenty years ago (winter 1996/97), 3.2 percent of US Americans still used the pistes to come down the mountains. The USA is therefore not exploiting its full potential – with a market as large as Europe but only a third of the skier visits. ts

Further information about the US American winter sports market and the complete 2020 International Report on Snow & Mountain Tourism can be found at www.vanat.ch.